It will be so sad to see that empty chair at the Berkshire Hathaway Annual Shareholder’s Meeting beside Buffett’s chair where both Buffett and Munger would be sharing their worldly wisdom and investing lessons. But what we will miss the most is the wit and wisdom of our dear Charlie Munger.

You are truly a cheerful pessimist. I felt very sad when the news channel showed Charlie Munger (1924-2023). Just 34 days were left to reach the 100-year-old milestone. Wall Street, Dalal Street and the investing world will be happy to celebrate your 100th birthday.

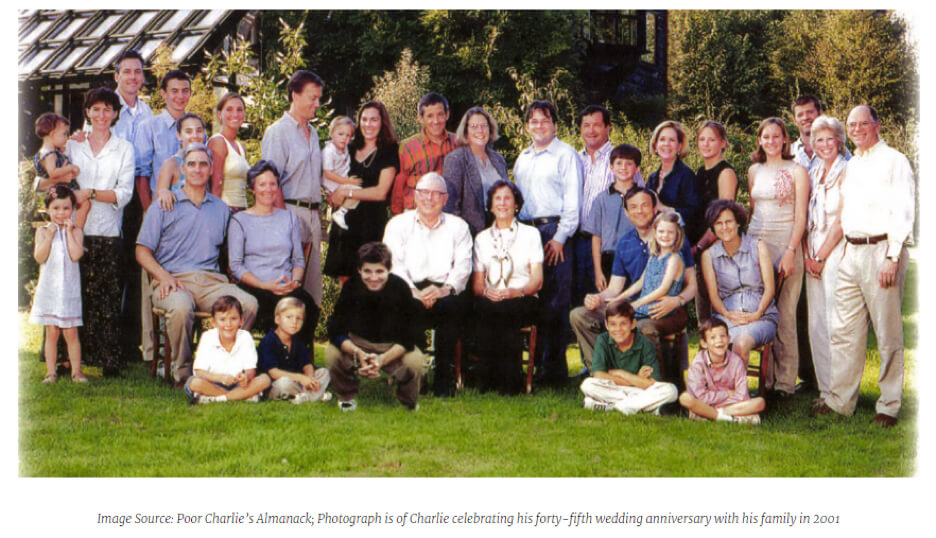

My parents and friends ask me if is there anyone in the investing world who is humble, wise and wealthy and lived a peaceful and joyous life on this earth.

“Yes, I know one such person, he is one of the humblest, honest, and wisest persons I’ve ever known in the investment and business world.”

Every true value investor or an investment professional’s once-in-a-lifetime wish is to take a picture with Charlie Munger and get his signature on “Poor Charlie’s Almanack” book.

But now this couldn’t happen as his earthly body has departed from this earth. However, as he is remembered, it is my hope the focus will not be on how or why he died, but on the countless moments of joy, wisdom and hope he gave to millions of people- his family members, colleagues, friends and investors.

Here are his following advice on how to live a long and happy life:

1. Don’t have a lot of envy.

2. Avoid resentment

3. Don’t overspend your income

4. Stay cheerful in spite of troubles

5. Deal with reliable people

6. Do what you’re supposed to do

Munger himself had a difficult life, including divorce, partial blindness, and the death of his son, Teddy Munger. But in the midst of all the troubles, he never gave up and focused more on being financially independent which is one of the best goals a hard-core value investor can achieve.

If you’re glued together and honorable and get up every morning and keep learning every day and willing to go in for a lot of deferred gratification all your life, you’re going to succeed.

– Charlie Munger

Charlie Munger has always been a big proponent of delayed gratification. He has emphasized the importance of patience and being prepared to act at scale when great opportunities arise. These are rare and fleeting, so we need to be patient, prepared, and decisive to seize them. Munger has shared an inspiring example.

Munger had been reading Barron’s magazine for more than fifty years and found only one actionable idea in it. It was cheaply valued auto parts company (the name is widely speculated to be Tenneco), which he bought at $1 per share and sold a few years later at $15 per share, earning him $80 million in profits.

Munger then gave Li Lu the $80 million and Lu turned this into $400 million. Through just two investments, Munger turned a few million into $400 million. This example illustrates the significance of extreme patience, deferred gratification, and displaying strong decisiveness at the right moment.

It is why Munger has said, “It takes character to sit there with all that cash and do nothing. I didn’t get to where I am by going after mediocre opportunities.”

Charles Thomas Munger was born on January 1, 1924 to Florence Munger and Alfred Case Munger, a reputed lawyer in Omaha, his paternal grand-father Thomas Charles Munger (July 7, 1861-November 29, 1941) was United States District Judge of Nebraska.

At a very young age, Munger’s mother taught him the value of hard-work and Munger understood in order to earn money, there must be value of exchange. So Munger started rearing hamsters and started trading in it. A happy childhood isn’t it, born to great well-educated parents, grandpa is a judge, well-respected and a brilliant man, above all Charlie Munger was a child prodigy who excelled in mathematics test without any rigorous preparation.

But his happy childhood is interrupted by Great Depression. When Munger was 5 years old, Great Depression occurred in USA, which was a global economic downturn that lasted from 1929 to 1939. It was considered the worst economic crisis in modern history and the longest and most severe economic depression ever experienced by the industrialized Western world. And due to this, everyone in the Munger family, even kids have to work for money at a young age. As a teenager, he worked at Buffett & Son for 12 hours a day earning him US$ 2 a month, a grocery store owned by Warren Buffet’s grandfather Ernest P. Buffett. It is here Munger developed a strong work ethics and appreciation for hard-earned money, based out of Gold.

In 1942, he enrolled in the University of Michigan, where he studied mathematics. Shortly after Munger started the college, World War-II broke out. The surprise attack at Pearl Harbour forced many young men out of college to join the US army and Munger was no exception.

Munger dropped out of college to serve in the US Army Air Corps, where he became a second lieutenant and he also received a high score on the Army General Classification Test, his superiors ordered him to study meteorology at Caltech in Pasadena, California, the town he was to make his home. And he became a meteorologist working and analyzing patterns of weather for war.

Meteorology was a empirical science, and in those days Munger and his colleagues in the army used prepare weather maps and stacked up those maps and by looking as one followed another they could see whether weather systems were moving and that’s way they were predicting the weather.

While taking physics course to prepare for his deployment, Munger learned to think like physicist. And physicists like to think in terms of fundamental and they are very cautious about their assumptions as result it helped Munger to build lot of mental models out of mathematics and physics, some of the famous is “Always Invert, Invert.”

During the military service and studying at Caltech in 1945, Munger married Nancy Huggins, Pasadena native. Together they had three children, Wendy Munger, Molly Munger and Teddy Munger.

Despite having attended many universities, Charlie lacked a bachelor’s degree. Nonetheless, using the GI Bill (Formally known as the Serviceman’s Readjustment Act of 1944, was a law that provided a range of benefits for some of the returning World War-II veterans), he applied to Harvard Law School, where his father had gone before him.

Charlie’s lack of an undergraduate degree threatened to derail him, but his family friend, former Harvard Law School dean Roscoe Pound, intervened on his behalf. Charlie was admitted despite the admission office’s intention to send him back to college.

Charlie ended up doing well at Harvard, but he did irritate a few individuals along the road. He was one of only 12 students in his class of 335 to graduate with magna cum laude degree from Harvard Law School in 1948.

After passing the California Bar exam, he joined the firm of Wright & Garrett, which ultimately became Musick, Peeler & Garrett. Charlie and Nancy, as well as their three children Teddy, Molly, and Wendy, lived in a house in South Pasadena.

First Phase: Successful law career

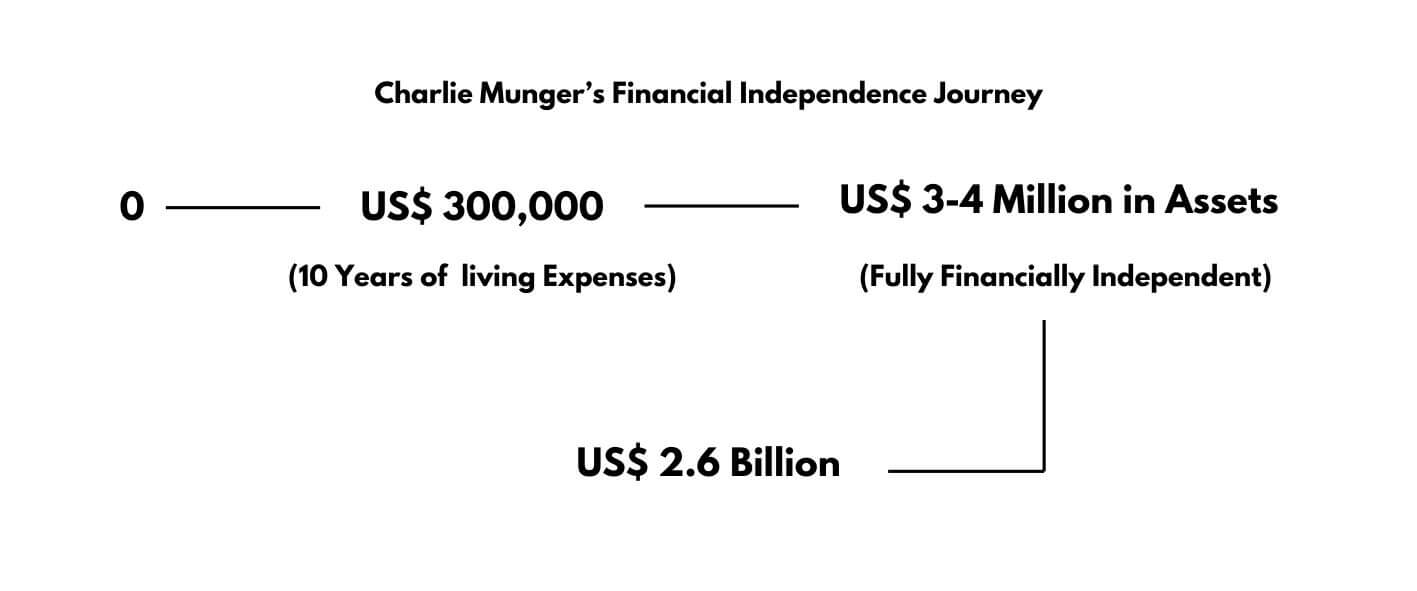

Munger started his career as a lawyer at a law firm Wright & Garrett and he became so excellent in his profession that in 1962, he founded and worked as a real estate attorney at Munger, Tolles & Olson LLP. Thereby accumulating US$ 300,000 in assets which is equivalent to 10 years of living expenses for his family (he now has a wife and several children). At this period, he also began working in real estate development. When this caught on, he stopped practising law.

Second Phase: Successful real-estate development venture and Investment Management

Munger achieved his first million dollars in real-estate. When advising a client named Otis Boothin a real estate development in Los Angeles, he partnered with Otis in a real-estate project in Los Angeles, a city in California.

From 1970s to 1980s, there was huge rush of people migrating to Los Angeles city, sensing this million-dollar opportunity, Munger decided to invest US$ 100,000/- dollars in real-estate project generating a 400% return. As this cycle continues, Munger and his partners completed 5 real-estate projects in the Los-Angeles city.

When he reached US$ 3-4 million in assets, he closed down his real-estate development firm. He was now “Financially Independent” but remained largely unidentified.

From 1962-75, Munger ran an investment partnership of his own, generated compound annual returns of 19.8% compared to a 5.0% annual appreciation rate of Dow. This was mentioned in Buffett’s essay in “The SuperInvestors of Graham and Doddsville”.

Also, he partnered with Jack Wheeler to form Wheeler, Munger & Co., an investment firm with a seat on the Pacific Coast Stock Exchange, also doing the business of market-maker. He wound up Wheeler, Munger, & Co. in 1976, after losses of 32% in 1973 and 31% in 1974.

During this phase, Munger had a bad investment in Transformer company based in California, but somehow, he was able to exit the business with a small profit.

But these all business-ventures could be done with Munger’s risk-averse steps and decisions of saving 10 years expense and finding the right life-partner who supported him during this phase and also Munger doesn’t want that if loss occurs, it shouldn’t affect his wife and kids.

Third Phase: Becoming Full-time Capitalist

The final stage is what propelled him to his position as a wealthy philanthropist. Along with his work with Warren Buffett in Berkshire Hathaway, he served as a Chairman of Wesco Financial, which expanded into a conglomerate of various wholly-owned firms as well as meticulously managed stock portfolio.

This all started with a company “Blue-Chip Stamps” which generated annual sales of US$100 million during 1960s and with strong cash-flow and cash reserves. But in 1963, Department of Justice had a issued a Anti-trust notice to this company making the Company to issue more shares to the public. And Buffett grabbed this opportunity and both Buffett and Munger bought huge stake from their respective investment partnership firms in this company as it was a cash-cow business.

They both had a huge stake in the “Blue-Chip Stamps” company that they can get a board seat in the company to exercise their control.

As they were successful in this hostile takeover, they were also able to take control of Wesco Financial. Munger previously served as chairman of Wesco Financial Corporation, which is now a completely owned subsidiary of Berkshire Hathaway. The acquisition of this firm was fraught with controversy, with allegations that Buffett’s company, Blue Chip, purchased Wesco stock in order to block an anticipated merger between Wesco and Financial Corporation. Wesco originated as a savings and loan association but has now expanded to include Precision Steel Corp., CORT Furniture Leasing, Kansas Bankers Surety Company, and other companies.

Life evolves and changes. Life is a roller coaster of ups and downs, with both triumphs and calamities, as Rudyard Kipling once stated. You are intended to feel pain, be hurt, and endure losses on times, just as you do when you are joyful and euphoric.

A huge takeaway from Charlie’s narrative is that life is not easy. And, contrary to what we assume in both triumph and tragedy scenarios, life is not designed to be a straight line of happiness and smiles, or grief and agony.

An unsuccessful procedure left him blind in one eye and resulted in problems such as cancer. His blind eye hurt so much that he couldn’t get up. Desperate to end it, he had the doctor remove his entire eye. Despite all this struggle, he learned Braille.

When the chips are down and things have fallen apart, all I need to do is start over. And find the courage to stand up and confront today with the same hope I had yesterday.

I’m sure that’s a valuable lesson for you, too.

Thank you for reading.